17 banks of Kyrgyzstan took part at the general meeting of the founders of the Association of Banks was held on September 15, 2005. The main objective of the meeting was to resolve all organizational and legal issues related to the revitalization of the Association of Banks.

As a result of the general meeting, several decisions were made. The withdrawal from the Association and the accession of new members to the Association of Banks, the Renaming of the Association into the Union of Banks of Kyrgyzstan (SBC), the approval of the new version of the Charter, the selection of the Supervisory Board of the Union of Banks, the selection of the Audit Commission of the Union of Banks and the determination of the amount of membership fees.

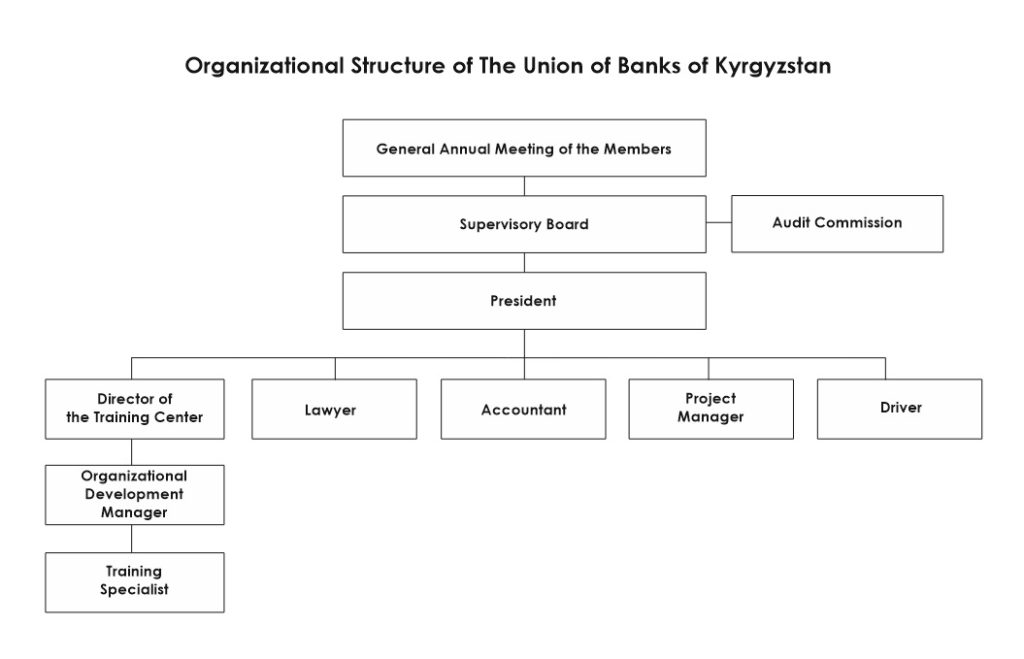

Coordination of the work of the new Union was entrusted to the Supervisory Board consisting of the first five heads of commercial banks of Kyrgyzstan: OJSC “Settlement-Savings Company”, CJSC “Demir Kyrgyz International Bank”, OJSC “KyrgyzСredit Bank”, OJSC “Bank-Bakai”, OJSC “Energobank”. The Chairman of the Supervisory Board was Anvar Abdraev – Chairman of the Board of OJSC “KyrgyzCreditBank”.

The functions of the President of the Union of Banks of Kyrgyzstan are temporarily assigned to the Chairman of the Supervisory Board, in accordance with paragraph 9.4. of the Statute.

Later, OJSC “AKB Kyrgyzstan”, CJSC “INEXIMBANK”, OJSC “FinanceCreditBank KAB” joined the Union of Banks of Kyrgyzstan.

Thus, for the first time in the history of the banking system, almost all commercial banks were merged, which was a confirmation of the desire of all members of the Union to work in an organized way to solve issues jointly.

Today the members of the Union of Banks are 24 commercial banks, 2 large microfinance companies, 1 leasing company, 3 associate members.